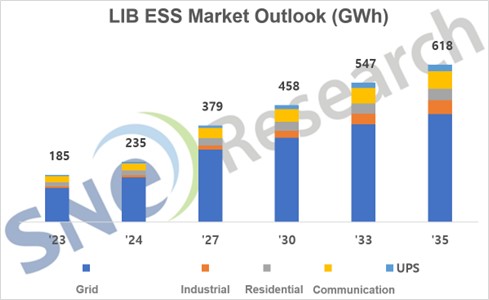

Global LIB ESS Market Expected to Reach 235GWh in 2024, a 27% YoY Growth

Source: <2024> Global ESS Market Outlook (~2035), published by SNE Research

This year, the LIB ESS market is expected to reach 235GWh, a 27% YoY growth. Converting it to dollar value, it is expected to reach 40 billion dollars (equivalent to approx. 53 trillion Korean won), a 14% YoY growth.

According to <2024> Global ESS Market Outlook (~2035) report published by SNE Research, the LIB ESS market is forecasted to reach 235GWh in 2024, and the market in 2035 is expected to grow up to 618GWh that is equivalent to 80 billion dollars.

ESS is widely used thanks to its capability of storing electricity. It draws keen attention in the smart grid industry where renewable energy is stored and used on demand. In particular, the ESS market using LIB with high energy density has been significantly growing.

In Korea, the ESS industry linked with photovoltaic energy thrived, but after a series of ESS fire incidents in 2018, the ESS market in Korea went through significant reduction. However, recently, as the ESS industry development strategy led by the MOTIE (Ministry of Trade, Industry, and Energy) was announced, there is a growing expectation on a possible market recovery. In addition, LG Energy Solution, Samsung SDI and SK On showed their willingness to resume their business in the ESS market by developing highly safe LFP battery for ESS.

The LIB ESS market is expected to grow at a CAGR of 10.6% from 185GWh in 2023 to 618 GWh in 2035. The major demand is smart grid. By country, China is expected to take up the biggest portion of ESS demand, followed by North America. The LIB ESS market in North America is forecasted to grow from 55 GWh in 2023 to 181 GWh in 2035.

A person related to SNE Research said, “The ESS market is a market expected to experience a huge growth next to electric vehicles. The ESS market is the only alternative for LIB companies and related players who have deeply concerned about recently rising chasm phase crisis.”